Business Sale and Shareholder Exit

EZ Consulting has direct experience in selling businesses and facilitating successful exits for shareholders.

In the majority of cases, owners of small and medium sized businesses will realise their investment through some form of trade sale or management buyout. The most significant component of the business’s value is based on the size and risk profile associated with future cashflows. Moreover, the strength of an owner’s bargaining position is closely linked to the potential offered by these cashflows for ongoing organic growth and/or a dividend stream.

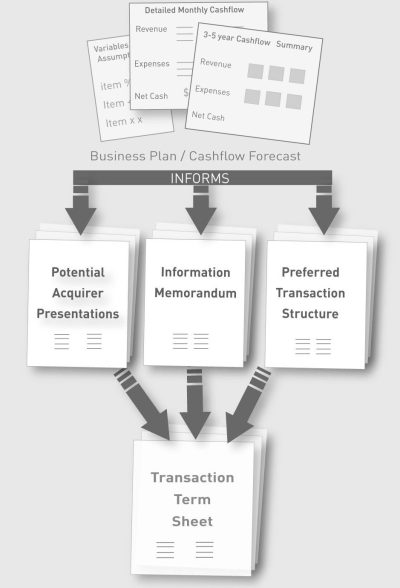

EZ Consulting’s detailed business plans provide a strong basis for predicting future cashflows and the ability to conduct rigorous “what if” analyses strengthen the credibility of these predictions and in turn the bargaining position of owners. A premium to cashflow valuations can be achieved when the business is able to demonstrate additional synergies available to the acquirer. These can be quantified through cashflow modelling and (when necessary) innovative buyout arrangements.

EZ Consulting has direct expertise and pro forma documents to assist with:

- business valuations

- structuring businesses to make them “sale ready”

- developing investor presentations and information memorandums

- structuring acquisition transactions

- drafting term sheets and sale contracts

- assisting acquirees in preparing for due diligence