Business Planning and Risk Mitigation

Let’s start with what a business plan shouldn’t be:

- A static Word or PowerPoint document

- A document with fluffy words such as “journey”, “vision”, “mission”

- A document that after it’s written isn’t used

- A document that doesn’t allow you to quantify the impact of changes in internal and external circumstances

- A document that doesn’t enable you to establish funding requirements to pursue new or expanded initiatives

EZ Consulting develops detailed business plans to assist businesses in achieving goals and monitoring performance.

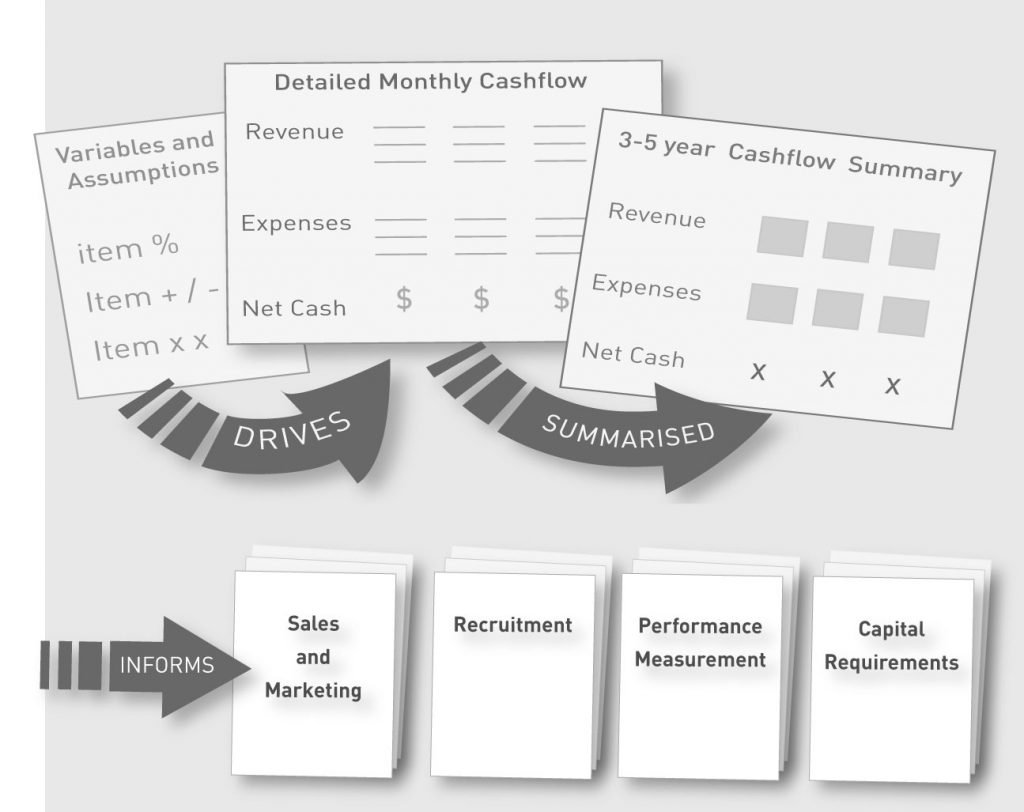

Typically, business plans will revolve around a detailed, rolling two-to-three-year cashflow forecast that is used to:

- Quantify funding requirements and manage the financial performance of the business

- Enable “what if” analysis by changing revenue and expense assumptions and variables

- Develop investment cases for presentation to government grant programs, private equity investors, venture capitalists, banks and the like

- Identify operational inefficiencies

- Implement risk mitigation strategies

- Inform sales and marketing plans

- Inform recruitment plans and performance-based remuneration plans

Depending on your industry and stage of development, a business plan should enable you to answer questions and quantify the impact on your business, such as:

- How much money do I need to start this business?

- How much money do I need to grow this business? At rate X? At rate Y?

- If someone was to invest in this business, what might their expected investment horizon look like? What rate of return might they expect?

- What does this business look like in six months? Twelve months? Two years?

- What if the business performs X% better than forecast, or Y% worse?

- What are my main revenue channels and what costs are associated with each channel?

- What are my true product margins?

- What degree of market penetration do I need to achieve to meet my revenue forecasts?

- Am I fully leveraging my assets (hard assets, intellectual property, know how, customer lists) and can I develop additional revenue streams from my existing assets?

- What supply channel risks am I exposed to and how can I mitigate these risks?

- What if the exchange rate changes?

- What is my marketing strategy and how does my marketing strategy translate into operational initiatives?

- Which of my marketing channels is providing the best return on investment?

- What is my staffing plan and what is the optimal timing for engaging resources?

- Should I be using full or part-time employees, contractors or external service providers?

- How can I link remuneration arrangements to business performance?

- What proportion of my revenue is used to cover administrative expenses?

- What if several operational parameters are changed simultaneously?